DataCheck Limited is Pakistan’s premier credit bureau organisation founded in the private sector in 2001. We work with Pakistan’s major financial institutions by facilitating them with credit information to screen and monitor borrowers. Our core strength lies in generating credit reports maintaining analytical tools that assist lenders in monitoring their loan portfolios.

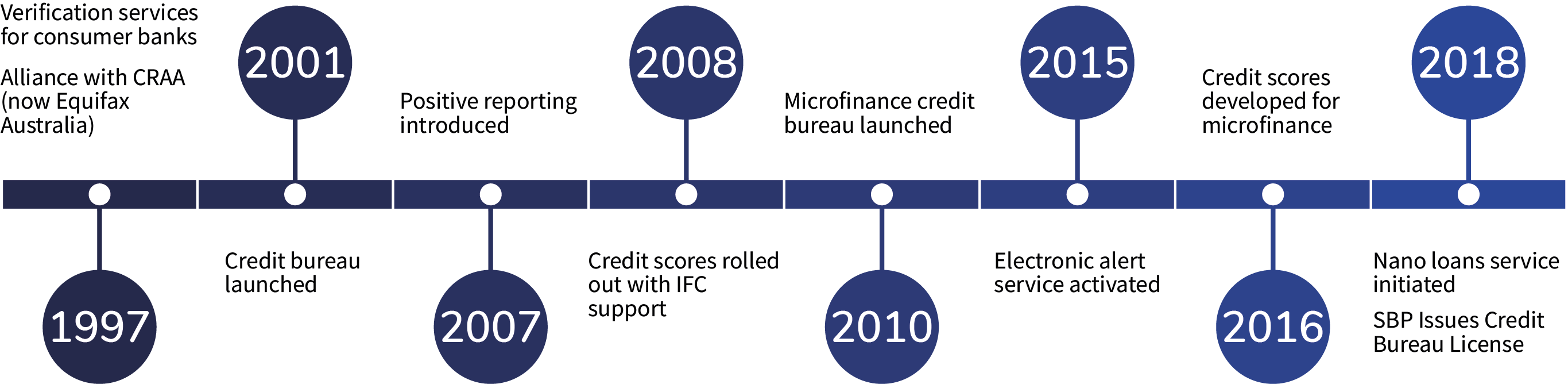

DataCheck initially launched as a ‘negative-only’ reporting service for consumer banks in 2001. As we gained the trust and respect of Pakistan’s fianancial industry, we expanded our portfolio to incorporate positive reporting services in 2007. With assistance from the International Finance Corporation (IFC), we introduced our Credit Scoring service – a powerful predictor of customer defaults- in 2008.

With success in demonstrating the value of our services to consumer banking, the microfinance sector requested DataCheck to offer its services to its own members. We launched our microfinance credit bureau at the national level in October 2013.

Our Commitment

Vision Statement

To earn the respect of our clients as the premium service provider of credit information solutions.

Mission Statement

To provide cost-effective credit risk solutions in an ethical and professional manner with a focus on creating value, ensuring the company's ability to serve its clients for years to come.

We are committed to

• Moral and ethical data-handling standards

• Customer-oriented service

• Good corporate culture, governance and practices

• A stable work environment for our employees and an opportunity for growth.

Milestones

Board of Directors

Zaffar Ahmad Khan

Chairman of the Board & Independent Director

Former President, Engro Corp.,

Former Chairman, Pakistan - Telecommunication Company Limited,

Former Chairman, , Pakistan International Airlines,

Former Chairman, Karachi Stock Exchange,

Former Director (two terms), State Bank of Pakistan Board.

Shahzad Shahid

Independent Director

Group CEO, TPS Worldwide

Board member CEC and Treasurer, P@SHA

Member, Advisory Council on IT & Digital Economy, Digital Pakistan

Director, Covalent

Vice President, Open Karachi

Former Chairman, P@SHA

Frabizio Fraboni

Independent Director

Former Principal Officer - Financial Institution Group at IFC - Vienna

Former Lead Financial Sector Specialist at World Bank Group, Istanbul-Vienna

Global Industry Specialist Access To Finance at IFC

Former Director of International Operations at CRIF Group, Italy

Former Director Business Development at Trans Union, Chicago USA --Bologna Italy

Tariq Nasim Jan

Sponsor Director

CEO, DataCheck Limited,

Former Executive Director, Phoenix Armour Private Limited (previously Brinks Pakistan).

Reza Nasim Jan

Sponsor Director

Sr. Consultant, Tony Blair, Institute of Global Change,

Former Senior Strategy Consultant, Strategy&,

Former Deputy Manager & Business Analyst, DataCheck Limited,

Analyst & Pakistan Team Lead, American Enterprise Institute - Washington D.C.

Our Management

Muhammad Adnan Khan

Head of IT

Certification

Partners

BDO Ebrahim & Co

Chartered Accountants - Auditor

Mohsin Tayebaly & Co

Law Firm Operating In Pakistan - Legal Advisor

FAQs

If you have any questions other than those mentioned below, please feel free to contact us. Keep visiting this page to stay up to date on new information and tips on your credit history, maintaining a good credit score and new products and services on offer.

DataCheck Limited,

Bahria Complex III,

M.T. Khan Road,

Karachi, Pakistan

OR

DataCheck Limited

P.O. Box 5512

Karachi, Pakistan

Some key information used to calculate your credit score includes your history of on-time payments (personal loans, credit cards, home loans etc.), the age of your credit history and the number of requests by lenders to view your credit. Requesting new credit too frequently can harm your credit score. Information such as race, gender and where you live are not used in calculating credit scores.

- Pay the installment amount that is owed on your account(s) every month.

- Budget – never buy on credit without knowing if you can afford the monthly installments to pay for your purchase.

- Never ignore a letter of demand for payment. Make a phone call or write a letter to explain your situation.

- If you are unable to make a payment due to unforeseen circumstances, talk to the credit provider concerned and make alternative arrangements to pay back what you owe.

- Ensure that you always supply the most accurate information about yourself on a new credit application.

- Check your credit report regularly to make sure that the information on your credit report is accurate and that your identity has not been used without your consent.

- Never ignore a summons to court for non-payment. Doing so could become a very serious reflection on your credit profile.